Switching to solar will save you thousands of dollars over the next 20-25 years.

It’s no secret that electricity rates are on the rise. In fact, according to Latitude Media, electricity prices have risen by nearly 20% since the beginning of 2021. This percentage falls in line with economy-wide inflation.

California is among the states hit the hardest. Not only are residents paying more for electricity compared to many other parts of the U.S., but California has also experienced higher frequency (and length) of power outages in recent years.

To help offset the cost of electricity, many homeowners are choosing to switch to solar energy for their homes. Aside from the environmental benefits, homes running on solar are immune to utility price hikes due to being energy independent.

Why energy independence matters

As we cover in our dedicated post on energy independence, a home that generates its own power rather than relying on traditional electricity is considered to be ‘energy independent.’ While we never recommend being completely off-grid for safety reasons, generating your own energy is a big money saver in the long-term and also allows you to live more sustainably.

The benefits of being energy independent don’t stop there. Solar-powered homes are better protected against local power cuts. This is especially true if you have one or more solar batteries where you store the excess energy your system produces. In short, by generating your own power, you become less susceptible to these disruptions, ensuring a more consistently stable energy supply.

The ROI of solar panels

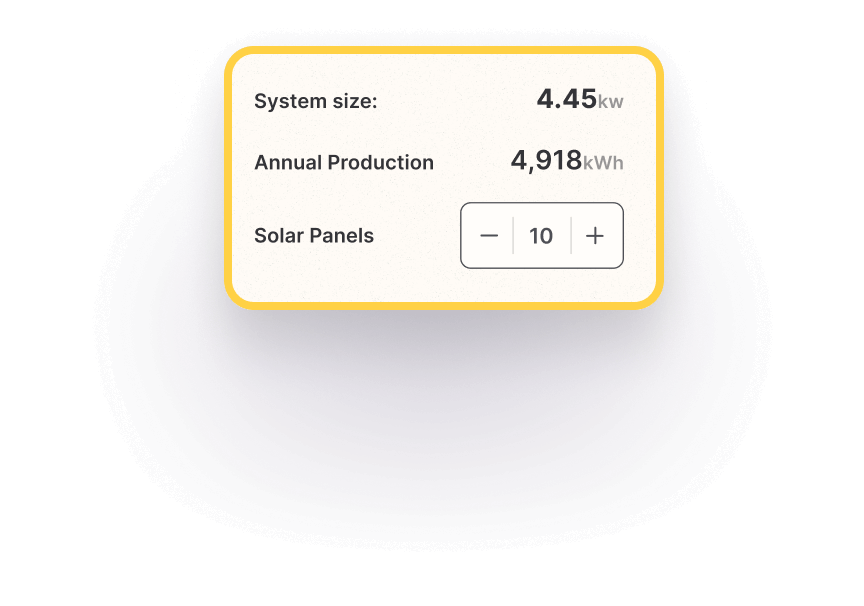

No matter how you look at it, choosing to switch to solar is a smart investment for homeowners. Systems are designed to last up to 25 years, during which time you’ll be saving on monthly electricity bills and fully powering your home from the energy your system produces.

Solar panel buyback period

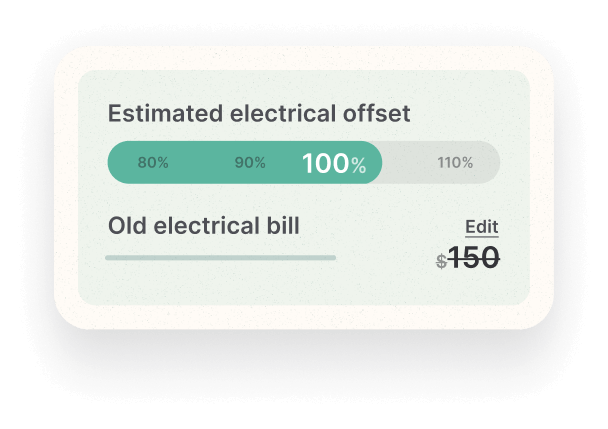

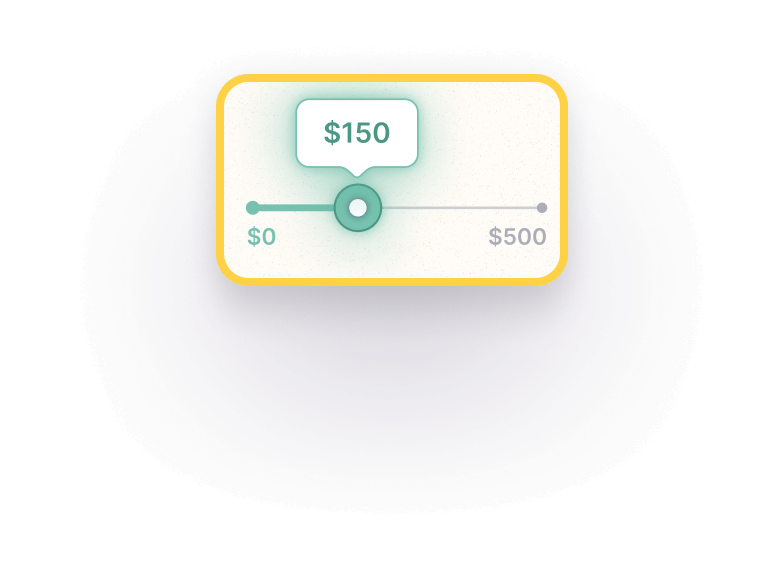

In the U.S., The average payback period is between six to ten years. This depends on several factors such as the size of the system, local incentives, and whether solar batteries are also purchased. It also depends on whether a homeowner participates in solar buyback programs, net metering, or leverage Solar Renewable Energy Credits (SRECs).

How much solar can save you

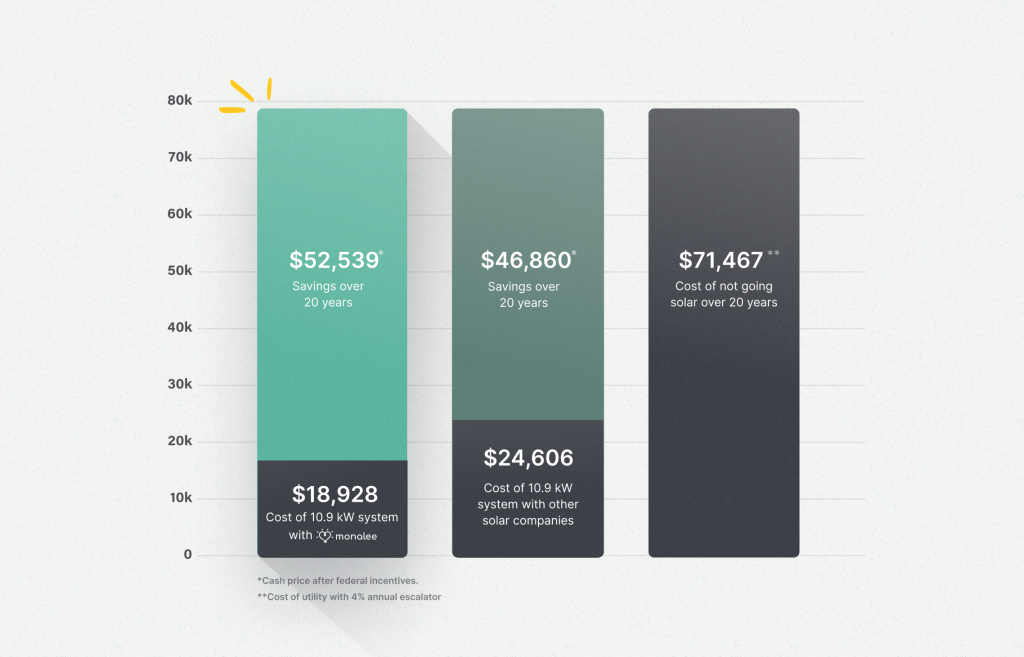

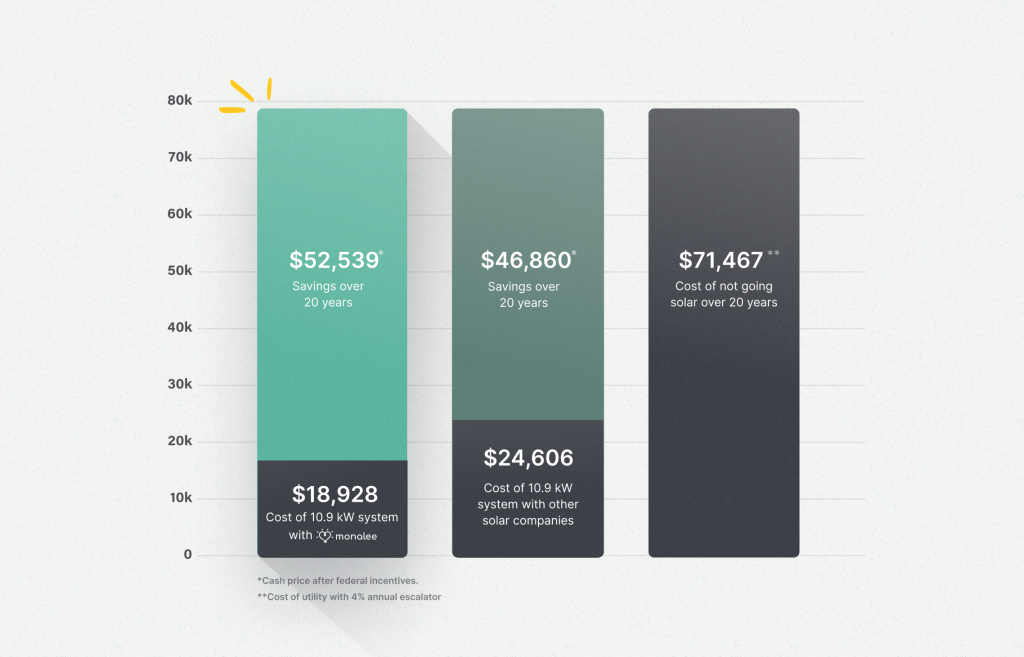

Most homeowners who choose Monalee can receive a return on their investment in as little as four to seven years. A big reason for this is because of our digital-first approach that eliminates commission-based salespeople and cuts soft costs by half.

As an example, here is what solar will save homeowners in Texas over the course of a twenty year period.

Best practices for hedging inflation

Below are a few tips for making the most of your home solar investment.

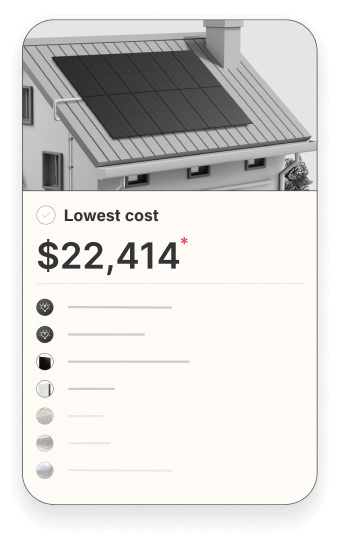

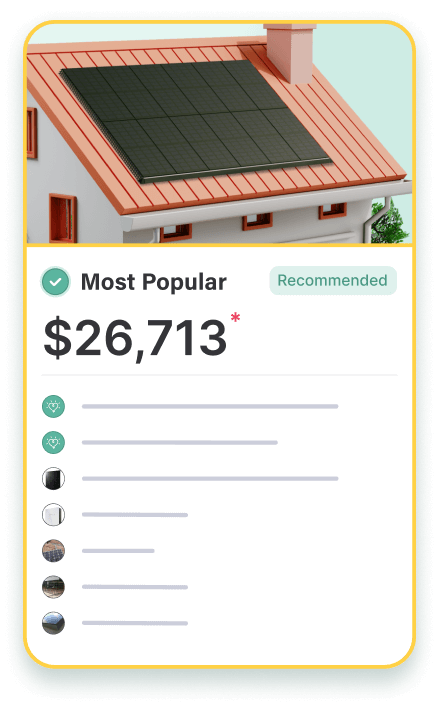

Choose your solar company wisely

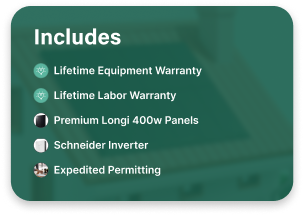

When choosing a solar company, it’s important to know what to avoid and what to look for. In general you’re going to want to sign up with a company that offers clear and transparent pricing. This way, you know exactly what to expect and can budget accordingly. The company you choose should also be expert in solar energy systems and have a team of skilled technicians they work with and trust.

In terms of what to avoid, we’d say that high-pressure sales tactics are pretty high on the list. If a company tries to sell you on guaranteed savings, or salesmen offer special programs that pay you to go solar, consider this a major red flag. Unfortunately, pushy salespeople have contributed to general distrust in the industry, which is one reason why at Monalee, we’ve removed commission-based salespeople from the process entirely.

If financing, apply for a fixed-rate loan

Going solar is a big investment, but there are many different ways to finance it. With solar loans, you borrow a certain amount to cover the upfront cost of the solar system and repay it over time with interest.

Ahead of qualifying for a loan, the solar financier will run a quick credit check as a preliminary measure. In most cases, you’ll need at least a 650 FICO score. Credit scores above 720 are helpful in securing you the best interest rate available. Locking in a low interest rate is ideal for homeowners who apply for a fixed-rate loan.

As we cover in our guide to solar loans, monthly payments for solar loans will be the same amount throughout the loan term. It will depend on the amount you put down as an initial deposit and the interest rate applied to your loan.

The one caveat we’ll mention here is that while it’s optimal to secure the lowest interest rate you can, you shouldn’t wait too long. Solar is a long-term investment and it ultimately pays for itself over time. So, the sooner you go solar, the sooner you can start saving on your monthly utility bill.

Consider investing in solar storage

At Monalee, nearly half of the homeowners we work with ultimately choose to add one or more solar batteries to their projects. While investing in solar storage comes down to one’s energy needs and personal preference, we’ve found that many homeowners prefer having that extra layer of protection against blackouts.

Solar storage also helps homeowners become more energy independent, as they rarely–if ever–rely on the local grid for electricity to power their home. Solar batteries are also quieter than generators and safe both inside and outside the home.

Adding batteries to your solar system also increases the value of your home, should you decide to sell it later on. Buyers are typically more inclined to choose a home on the market with a solar system already up and running, as it means instant savings for them.

Final Thoughts

While it’s true that inflation erodes purchasing power, investing in solar energy for your home is a smart way to come out on top. With prices on just about everything going up—including electricity—being energy independent makes you immune to the price hikes all while living a more sustainable lifestyle and offsetting your carbon footprint. To hedge inflation, opt for a fixed-rate loan if and when possible and consider adding solar batteries to your system for added energy independence and further long-term savings.