When thinking about switching to solar power, the hefty initial cost often makes people hesitate, even when considering the long-term financial savings it brings. Thankfully, there are solar financing options available that allow you to enjoy solar energy savings without facing the upfront expense.

Our guide to solar financing will explore the available options, empowering you to select the most suitable one for your home and circumstances.

What is solar financing?

Solar financing allows homeowners to install solar energy systems without paying the entire upfront cost out of pocket. Instead, they can opt for financing options that spread out the cost over time, making solar energy more affordable and accessible. It’s a great way to make the switch to renewable energy without a hefty initial investment.

How does solar financing work?

The solar installer you choose might offer a tailored loan to help cover the system’s cost. These companies—including Monalee—often provide end-to-end services, handling installation and financing alike.

A solar loan operates similarly to other installment loans, like personal loans, where you commit to repaying the borrowed amount over time, along with accrued interest. Loan terms, interest rates, and monthly payments can differ based on the provider, each having its own set of credit and financial requirements.

Solar financing not only enhances your home’s sustainability but also maximizes the efficiency of your investment. Plus, obtaining a loan through a solar installer is convenient. The application process is streamlined, typically managed directly through the installer, and loan payments are made to them.

Solar financing options

There are four primary ways to pay for your solar panels: an upfront cash payment, solar loans, a cash-out refinance plan or Home Equity Line of Credit (HELOC), or a lease or power purchase agreement (PPA).

Cash payment

Some homeowners choose to pay for their entire solar system upon installation. While this may seem overwhelming at first, you could benefit from owning the system right away.

Advantages

If you can afford it, buying your solar energy system upfront is the best way to increase its return on investment (ROI). Avoiding interest payments on solar panel financing allows you to take full advantage of solar tax credits and extra incentives.

Disadvantages

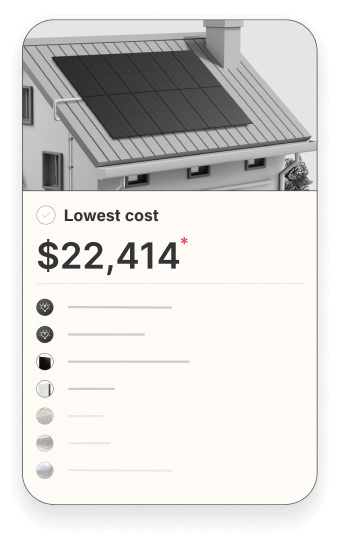

The main drawback is the substantial initial investment required. Solar energy systems typically range from $8,500 to $30,500 (depending on several factors), which can be challenging for many homeowners. As the system owner, you’re also responsible for paying for any repairs or replacements not covered by the warranty.

Solar loans

Solar loans are traditional loans specifically tailored for financing solar installations. You borrow a certain amount to cover the upfront cost of the solar system and repay it over time with interest. Various solar financing options are offered by solar providers and private lenders, with secured and unsecured loans being the main types.

Secured loans

Secured loans utilize your home as collateral for borrowing. Typically, they come with lower interest rates compared to unsecured loans.

Unsecured loans

With unsecured loans, the solar system serves as the collateral for borrowing. Lenders generally require a higher credit score for qualification. Solar panel financing rates tend to be higher for this loan type because of the increased risk assumed by the lender.

Advantages

Acquiring a loan to finance your solar system grants you ownership of the system and more energy independence. This makes you eligible for government tax credits and similar incentives, leading to even more savings.

Disadvantages

The primary drawback of solar loans lies in the interest rates. Additionally, like other types of loans, failure to keep up with payments may result in the loss of collateral.

Cash-out refinance or HELOC

A cash-out refinance plan or Home Equity Line of Credit (HELOC) leverages your home equity. With a cash-out refinance, you can refinance your mortgage to cover the expenses of purchasing and installing your solar energy system. HELOCs provide you with a line of credit that you can use as needed.

Advantages

Cash-out refinance plans and HELOCs help homeowners finance solar panels without paying all at once. Similar to finance plans, homeowners retain ownership of the system and can benefit from tax credits and other incentives. They also typically feature lower interest rates compared to unsecured loans.

Disadvantages

Defaulting on these plans may result in the loss of your home. With variable interest rates, HELOCs are less predictable than conventional personal loans. Cash-out refinance plans require borrowers to pay closing costs, which typically range from 2% to 6% of the total premium.

Solar lease or power purchase agreement (PPA)

Solar leases and power purchase agreements (PPAs) used to be significant in solar industry growth, but we recommend against them. These arrangements involve a third-party owner (TPO) that installs, owns, and maintains the solar system on your property. The TPO then sells the generated solar power to the homeowner at a fixed rate, usually lower than what they’d pay their local utility company.

Advantages

Renting a solar energy system offers immediate access to solar power without a large upfront investment. It can be beneficial for short-term residents and eliminates maintenance responsibility, as it falls on the system owner.

Disadvantages

Since monthly payments don’t contribute to system ownership, long-term ROI is limited. If you decide to sell your home, you’d have to pay off the entire lease or convince the new homeowners to take over. Additionally, you won’t be eligible for solar tax credits or rebates.

Solar financing with Monalee

Here at Monalee, we’ve partnered with two financing companies to help make solar more accessible to you as a homeowner. Solar financing with Monalee through GoodLeap and Mosaic provides the following benefits:

- $0 down

- Replaces your electric bill, usually at a much lower rate

- No lien on your home

- Own your system, own all your power

- No utility price hikes

- Energy independence

- Currently subsidized by the government

- Adds value to your home

- No pre-payment penalties

- Equity in your energy, just like equity in your home

Final thoughts

When considering solar financing options, it’s essential to weigh the upfront costs, long-term savings potential, and ownership benefits. While each option has its advantages and drawbacks, understanding the nuances of solar financing can help you make an informed decision that aligns with your financial goals and energy needs.

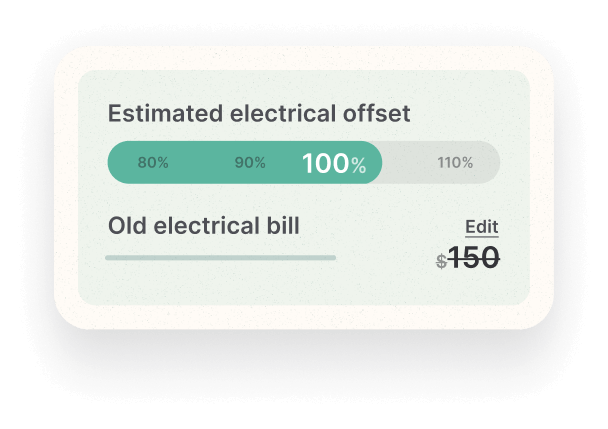

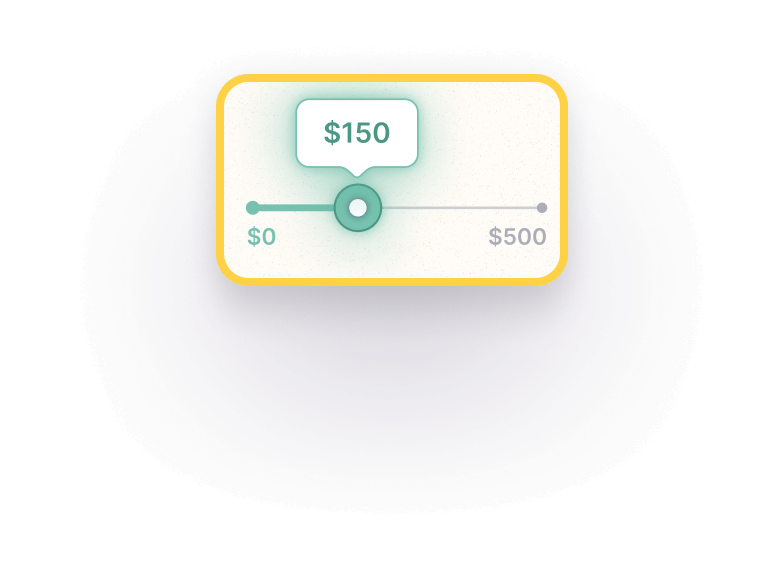

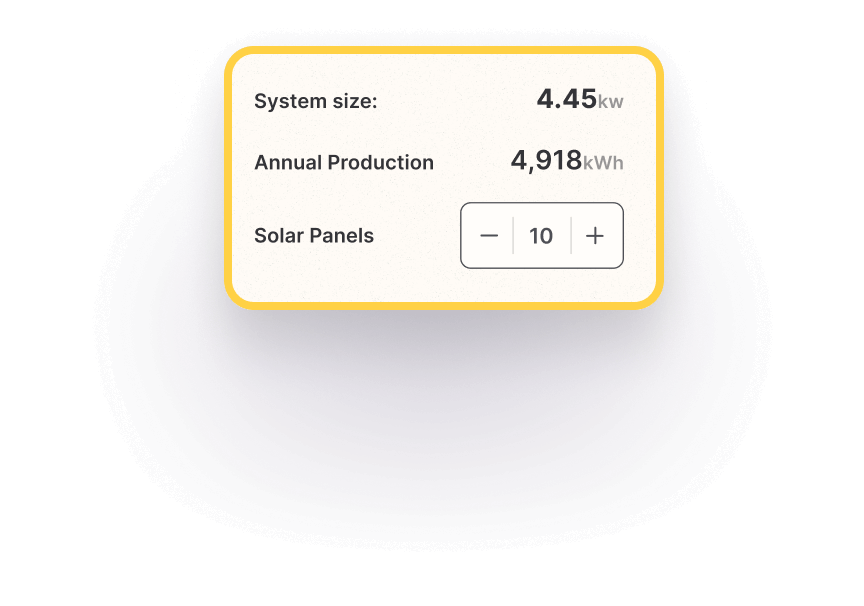

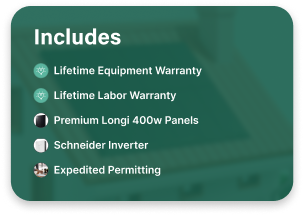

Opting to purchase your system outright or securing a low-interest loan are the best options to maximize your savings. Get started with Monalee today with a free quote that provides you with real-time pricing updates as you customize your solar system details.