It's about that time! Tax season is fun for very few of us, but once in a while, we catch a break. Here's what to know ahead of filing.

Even though you won’t be filing your 2024 taxes for at least another year, now is the perfect time to get started. Remember, the process of getting your solar panels up and running can take anywhere from six weeks to a couple months (and much longer at other solar companies in the country).

Here’s a quick breakdown of everything to know leading into the 2024 tax year.

How do tax credits work?

Tax credits are different from tax deductions (for example, a business expense) and tax exemptions. Credits are dollar-for-dollar reductions in what you owe to the government, which is based on your total yearly income.

When you install solar panels, you earn a federal tax credit and this translates to a lower tax bill. Depending on your income and several other factors, you’ll either pay a lower tax bill or receive a tax refund.

What is the solar tax credit and what does it get me?

The federal government enacted the solar Investment Tax Credit (ITC)—more commonly referred as the “solar tax credit”—in 2006 and since then, the solar industry has grown exponentially.

The tax credit encouraged more homeowners to adopt sustainable energy which in turn created hundreds of thousands of jobs for solar industry professionals. According to Forbes, the solar industry in the U.S. has grown by more than 10,000% with an average annual growth of 50% over the last 10 years.

More recently, in 2022, President Joe Biden signed what we know as the Inflation Reduction Act. This gives homeowners a tax break on solar through 2034.

Here are a few key takeaways:

-

- Between 2022-2032, homeowners can receive a 30% tax credit on their installed PV systems (photovoltaic panels, otherwise known as solar panels)

-

- Starting in 2033 (filing taxes in 2034), the solar tax credit drops to 26%

-

- By 2034 (filing taxes in 2035), the solar tax credit drops to 22%

What does the solar tax credit cover?

Historically, the solar tax credit can cover the expenses of your solar equipment, such as the panels themselves, as well as the cost of installation. It won’t, however, cover any structural work needed to better support the panels.

Here’s a quick breakdown of what’s covered:

-

- The price of the solar panels

-

- Solar installation equipment: inverters, wiring, hardware to mount the panels

-

- Associated labor costs: any fees related to getting necessary permits, local jurisdiction inspections

-

- Solar power storage equipment, such as solar batteries

-

- Any sales taxes paid for the installation (if required; some states waive this)

My panels are already installed. What do I need to know for filing 2023 tax returns?

We’re glad to hear! To claim your credit, you’ll need to ask your tax preparer to fill out IRS Form 5695.

-

- File your solar system as “qualified solar electric property costs”

-

- Line 1 asks you to enter the total amount you paid for the project (this will be the dollar amount listed in your contract)

-

- Lines 6a and 6b will ask for detailed calculations of your solar expenses, so make sure you have this info easily accessible

-

- Line 14 asks you to calculate any tax liability limitations. Use this IRS worksheet for guidance

It’s also worth noting that, as part of the residential clean energy credit, other types of renewable energy projects are also eligible for credits.

We suggest working with a tax professional who’s deeply familiar with solar tax credits.

I plan to go solar in 2024. What should I know ahead of time?

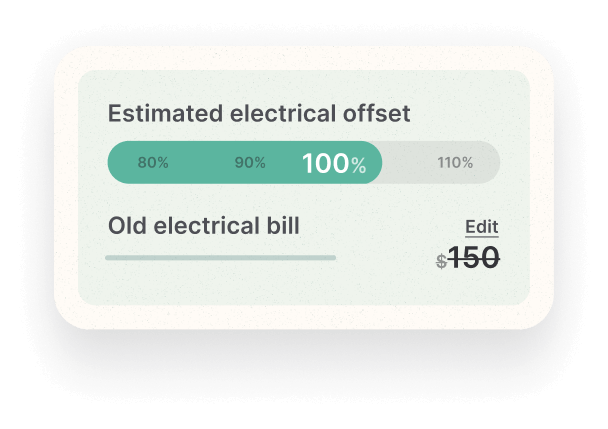

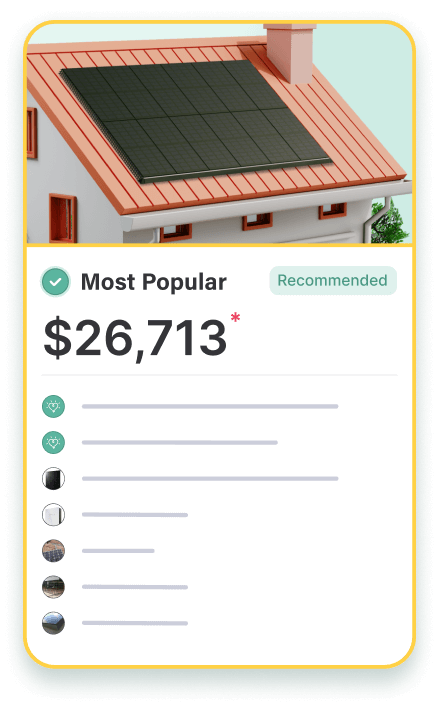

The good news is that you can expect a tax credit of 30% toward the equipment and installation of your solar panels. Even though we realize going solar is a significant expense up front, it’s reassuring to know that you’ll recoup a lot of that money with your next tax filing.

As you go through the process of site inspection, solar design, permitting, installation, and permission to operate, just keep track of all your paperwork. Even though you won’t need it all, it doesn’t hurt to provide your tax preparer with more information than they might need…or, at least be able to pull it up easily if asked.

What you do want to keep track of are itemized receipts and payment confirmations. You’ll also want a certification from the equipment manufacturer, as this is required when it’s time to file.

If I have until 2034 to benefit from a solar tax credit, what’s the rush?

Going solar is a personal decision and while we personally can’t recommend it enough, we realize that there are other factors at play.

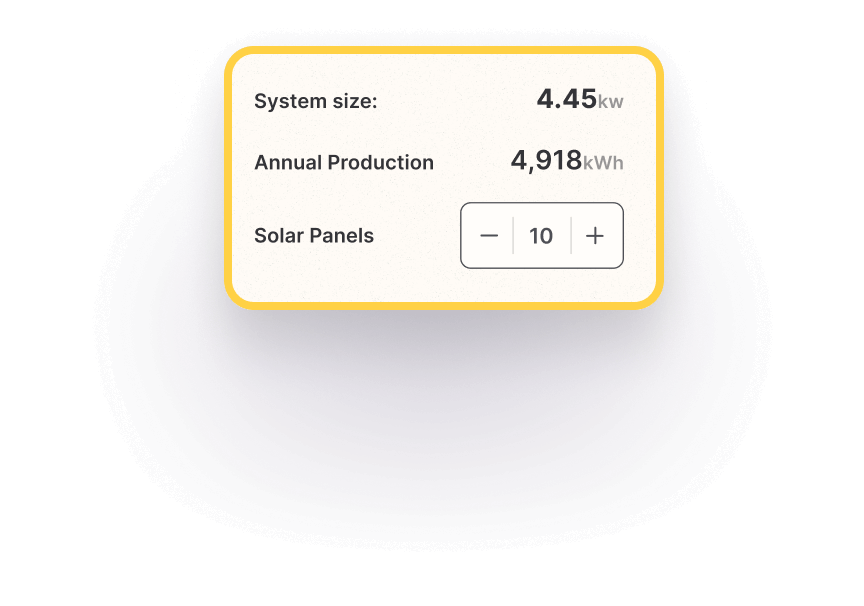

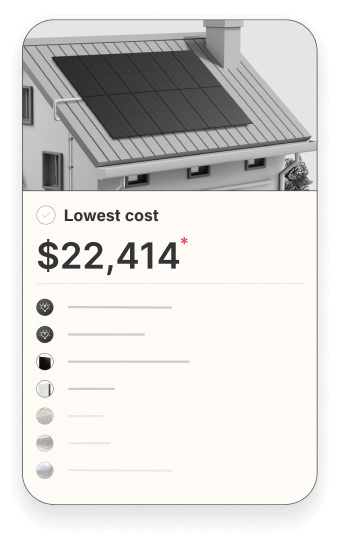

That said, solar energy technology is the best it’s ever been. It’s also less expensive and more efficient. At Monalee, we’re able to secure the same solar panel systems at half the price compared to the top traditional solar companies in the U.S. We do this by simply removing salespeople and system designers from the process and leveraging patented machine learning.

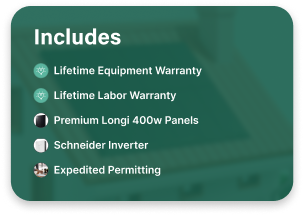

We offer three guarantees for all customers (most companies only offer the first two):

-

- Parts. We make sure to use quality equipment on all Monalee installs. Should problems arise down the line, we’ll make sure your repairs are taken care of quickly.

-

- Labor. We pride ourselves on offering our customers a premium and professional service, choosing to partner with the industry’s most reputable installers.

-

- Performance. We guarantee that our solar panels will produce as much energy as is stated on your unique Monalee quote. Valid for 25 years.