Securing a solar loan is one common way homeowners go solar. Here's everything you need to know.

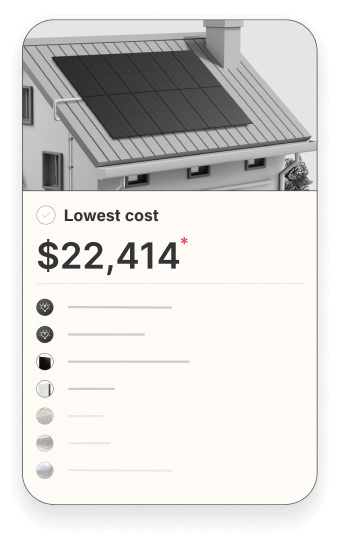

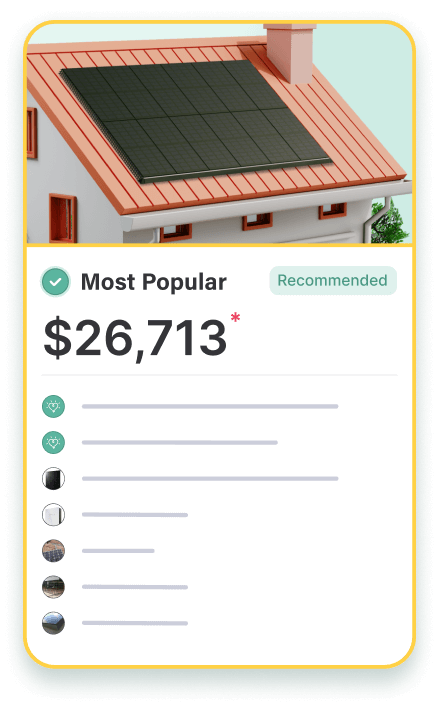

Going solar is a big investment, but there are many different ways to finance it. Solar loans are traditional loans specifically tailored for financing solar installations. You borrow a certain amount to cover the upfront cost of the solar system and repay it over time with interest. Various solar financing options are offered by solar providers and private lenders, with secured and unsecured loans being the main types.

In this blog post, we cover the terms and conditions that apply to most solar loans, as well as what you can do to better secure a lower interest rate.

Loan terms (length)

While signing up for a solar loan does lock you in for a set number of years, the good news is that the terms are fairly flexible. In most cases, the homeowner has control over how much they put toward a down payment, and this can be anywhere from 0-100%.

Homeowners are also able to set the term–or length–of the loan. In general, this range will be anywhere from 5 years to 25 years, with 12 years being the average. Sometimes, it might make the most sense to opt for a longer term so that you can spread your monthly payments so that they match the amount that your solar system is saving you in utility bills.

As a general rule of thumb, shorter loan terms will have higher monthly payments but you’ll pay less toward interest. This means that longer term loans have lower monthly payments but you put more money toward interest in the long-run.

Interest rates

When you sign up for a solar loan, you will also be paying interest as part of your monthly payments. Similar to mortgage rates, interest rates for solar loans rise and fall based on how well–or poor–the economy is doing. As you probably remember, interest rates plummeted during the pandemic but have since risen.

As reported by Forbes, interest rates on solar loans generally range from 4% to 7% but can go up to around 36%. They share that ultimately, the cost of borrowing depends on several factors, including interest rate, term length and fees.

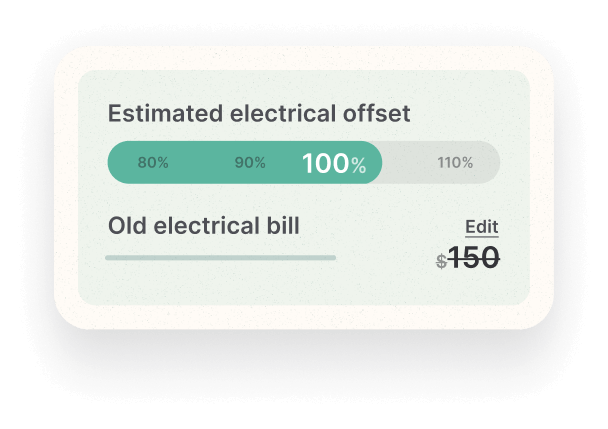

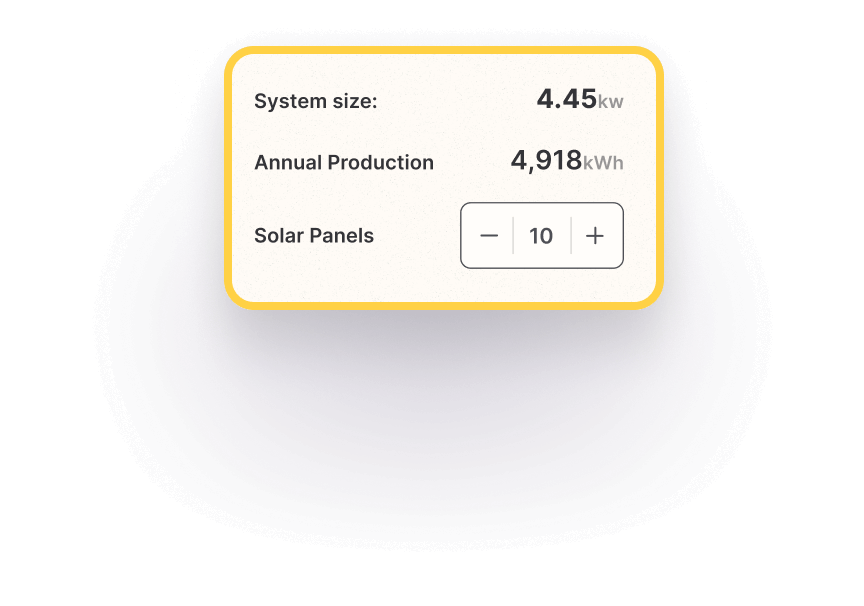

Monthly payments

Monthly payments for solar loans will be the same amount throughout the loan term. It will depend on the amount you put down as an initial deposit and the interest rate applied to your loan.

Here are three different numbers to note:

- Monthly payments: this is the monetary amount that you owe your financier every month. Part of this amount goes toward interest.

- Total interest payments: this is the amount of money you end up paying in interest over the duration of the loan term.

- Total loan payments: this is the full amount you end up paying throughout the loan’s term, and it includes both the loan principal and interest.

Qualifying for a solar loan

While macroeconomic forces influence how high or low your interest rate will be, there are a few ways to lock in a lower rate for your solar loan. The first thing any solar financier will do is check your credit, so make sure you have at least a 650 FICO score. Credit scores above 720 are helpful in securing you the best rate available.

If you’re waiting for interest rates to drop before making the switch to solar, you might be waiting awhile. Yes, interest rates will eventually drop but we don’t recommend waiting too long. Solar is a long-term investment and it ultimately pays for itself over time. So, the sooner you go solar, the sooner you can start saving on your monthly utility bill.

In Conclusion

When considering solar financing options, it’s helpful to weigh the upfront costs, long-term savings potential, and ownership benefits. Most solar leases are about 12 years, although they can be as short as 5 years and as long as 25 years. Right now, interest rates are between 4-7% on average and having strong credit may help you secure a lower rate for your solar loan. At Monalee, we work with two financiers that we really trust: GoodLeap and Mosaic.