A beginner's guide to understanding how long the solar panel payback period will be for your home.

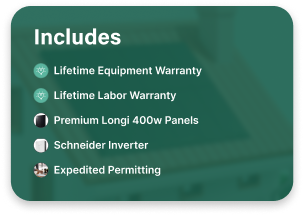

Going solar might be a big investment upfront, but it ends up paying for itself in the long run. While it’s true that solar prices vary depending on many different factors including location, the square footage of a home, personal energy needs, and how high quality the equipment is, you can still get a fairly good idea of how long it will take to recoup your costs.

From understanding average utility costs and annual fare increases to leveraging statewide solar incentives and tax rebates, here are four factors that help you determine solar ROI.

Residential utility price surges

It’s no secret that in most US states, residential utility rates continue to rise year over year. California, in particular, is no stranger to electricity spikes. At the start of 2024, Pacific Gas and Electric Company increased residential electricity rates by 20% and a second annual increase is already in the works. A few other states that saw electricity spikes include Arizona at 10.4%, Maryland at 8.6%, and North Carolina at 15.4% to name a few.

Understanding statewide residential utility rates will help you determine how much switching to solar energy will save you on a monthly basis. Homeowners in states with the highest fees have the most to gain from switching to solar energy, and could start seeing savings as early as two to three billing cycles after activating their systems.

Statewide incentives, rebates, and tax credits

On a federal level, homeowners who switch to solar energy can recoup 30% of their costs toward equipment and installation. It’s worth noting that tax credits are different from tax deductions (for example, a business expense) and tax exemptions. Credits are dollar-for-dollar reductions in what you owe to the government, which is based on your total yearly income.

So, when you install solar panels, you earn a federal tax credit and this translates to a lower tax bill. Depending on your income and several other factors, you’ll either pay a lower tax bill or receive a tax refund. Aside from making solar energy more financially accessible to more people, the tax credit ultimately creates hundreds of thousands of jobs for solar industry professionals.

Each state also has their own set of solar incentives, rebates, and tax credits. Aside from the 30% federal solar tax credit, South Carolina residents have a generous 25% state solar tax credit to offset the total cost of their systems. Residents even have the option of rolling over any unused credits from one year to the next, for a maximum of ten years. In Arizona, residents are offered a tax credit for the cost of solar installation, up to a maximum amount of $1,000.

Other states, such as Colorado and Florida, offer property tax exemptions. This means that homeowners who install a solar system will not be taxed on the increase in value of their home. On average, homes with solar systems increase in value by an average of 4.1-percent. Solar equipment is often exempt from sales tax, which varies by state. For example, Connecticut’s sales tax is 6.35%, while Arizona’s is 5.6-percent.

Year-round weather conditions

The truth is that solar panels work just fine in various types of weather conditions. After all, they’re built to last upwards of 25 years. In fact, solar panels go through rigorous rounds of testing to ensure that they’re as durable as designed. During these tests, they’re met with all types of weather conditions–rain, hail, sleet, snow, you name it–as well as other obstacles they could come in contact with such as baseballs and fallen tree branches.

That said, some states are simply sunnier than others, and therefore set up for optimal efficiency from the start. This is true for many parts of California, Florida, South Carolina, North Carolina and other mostly warm and sunny parts of the country. What matters most for solar production is the amount of sunlight the panels receive per day. Locations where it is cloudy or rainy for most of the year will produce slightly less energy than those with ample amounts of direct sunlight.

Your home’s unique layout and energy needs

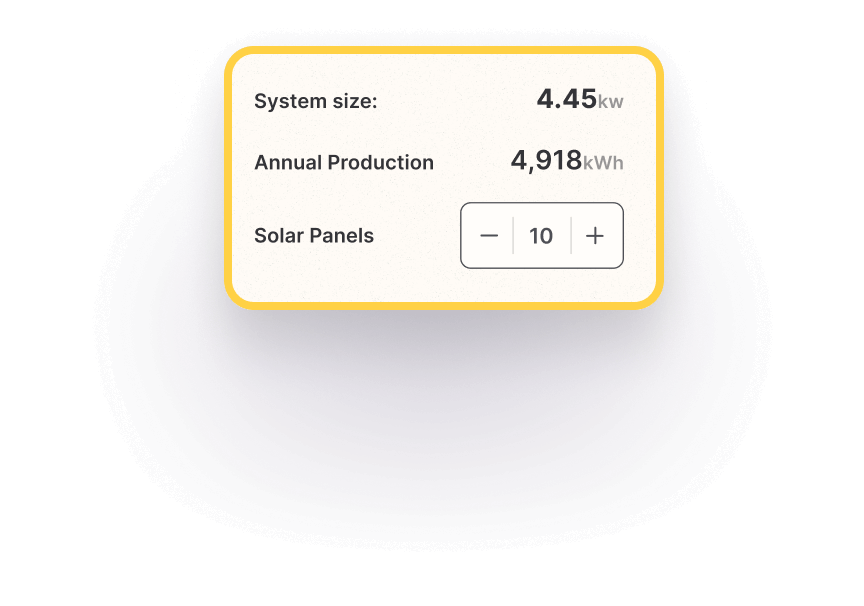

Defining your personal energy needs is an important step in choosing whether or not solar is right for you. In general, bigger homes are going to require more energy to run. Location matters, too. For example, If you live in an area that can get extremely hot or cold, you’ll need extra energy for air conditioning and heating respectively.

The presence of roof obstacles such as chimneys or roof vents can alter where the panels are placed and the amount of production. If there are trees in your yard that cause one or more solar panels to be in shade, that is also going to reduce production.

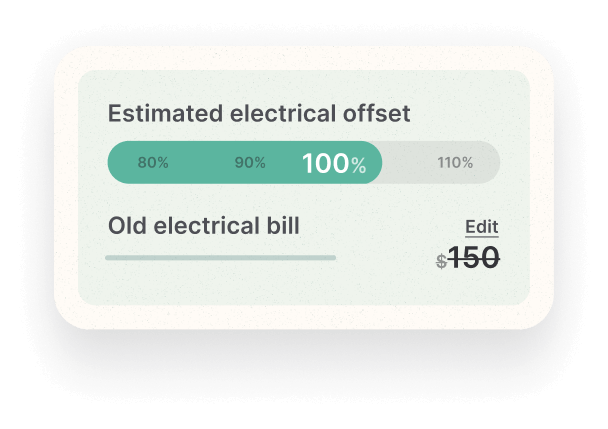

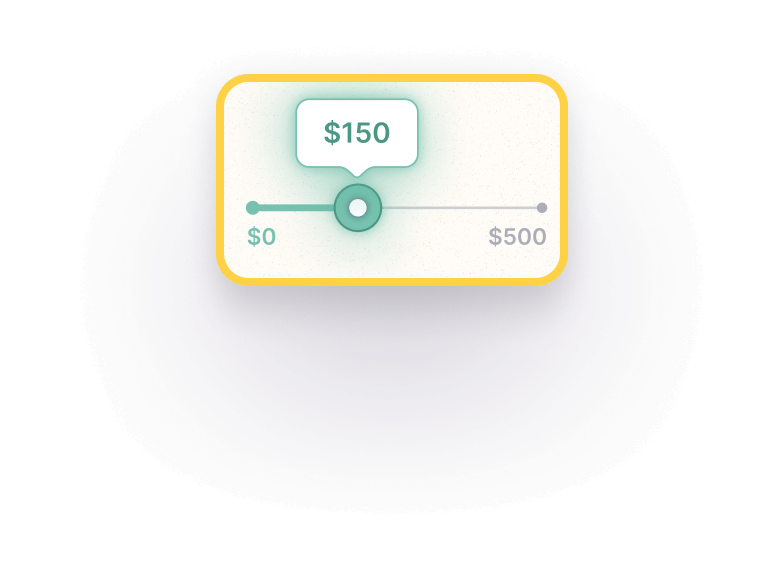

At Monalee, our goal for every homeowner is to get them to 100% offset–meaning that their monthly utility bill goes down to zero. Our patent-pending technology scans for potential roof obstacles and trees that might create shade over your panels.