Some states offer solar renewable energy credits, which let you earn a return on your solar panels.

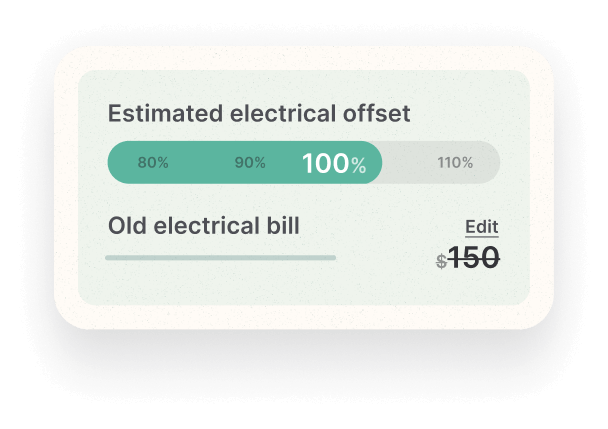

Going solar comes with significant benefits for both homeowners and the planet. In most cases, homeowners who switch to solar will be able to fully offset their electricity costs for years to come. Solar panels may cost a lot at first, but they eventually pay for themselves. Other financial incentives include the Federal Investment Tax Credit (ITC), net metering, rebates, and much more.

Some states offer solar renewable energy credits (SRECs), which let you earn a return on your solar panels. Utility companies may buy these certificates to meet their state’s Renewable Portfolio Standard, a requirement that a minimum amount of their renewable energy comes from solar.

How do SRECs work?

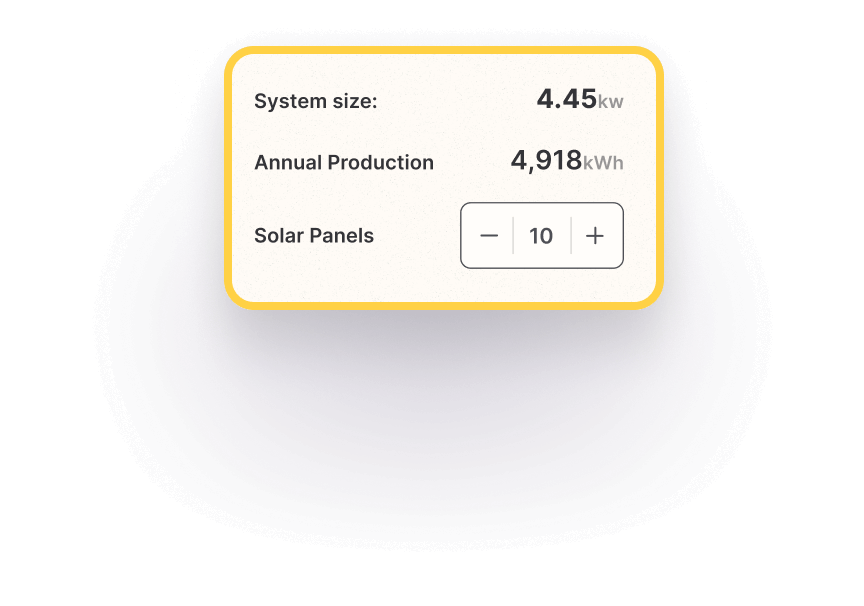

The best way to understand how Solar Renewable Energy Credits (SRECs) work is to think of them as vouchers. In the case of solar, these are vouchers that prove that the electricity produced from a homeowner’s solar system is renewable. Homeowners with solar earn one SREC for every 1,000 kWh of electricity their systems produce.

The prices of SRECs are influenced by demand, so prices vary. Generally, solar renewable energy credits are bought for anywhere from $50 to $300.

Why do SRECs matter?

SRECs matter because many utility companies are required to buy a certain amount of them every year in an effort to meet specific sustainability requirements set by the renewable portfolio standard (RPS) in each of the fifty states. If that set number isn’t met, the utility company or energy supplier faces fines called Alternative Compliance Payments (ACPs).

In order to meet the required minimum amount of credits, utility companies can either create their own solar projects or buy them on the open SREC market. Currently, 38 states and Washington D.C. have an RPS in place, and seven states that have SREC markets.

SRECs vs. RECs

REC stands for ‘Renewable Energy Certificate’ and operates a little differently than SRECs. SRECs refers to electricity produced from solar photovoltaic systems, while RECs are more all-encompassing and include different sources of clean energy. In short, a SREC is a version of a REC and solely specific to solar.

How to sell your SRECs

SRECs serve as added motivation for homeowners who switch to solar because it’s a way to earn money back on their initial solar investment.

1. Register your solar system

Before anything, you’ll want to register your solar system with your area’s Public Service Commission. From there, you’re going to submit your system to what’s known as the General Attribute Tracking System. This system—called GATS for short—is a regional transmission organization that manages the electric grid for the states that offer SRECs.

While many solar installers handle this process for you, it’s not uncommon to register it on your own. There are also SREC companies available for hire.

2. Decide how you want to sell your SRECs

After registration, you’ll have a choice of how you want to sell your SRECs. There are three main options:

Upfront payment

When you opt for upfront payment, you sell the rights to all of the SRECs your system will ever produce and you receive a lump sum payment upfront. After that single payment, you won’t receive any payments for the lifetime of your system. It’s a good option for homeowners looking to minimize out-of-pocket costs associated with their solar systems or those who want to reduce market risk and future price fluctuations.

A set contract

Signing a contract with an SREC aggregator locks homeowners into a set SREC price for a certain duration of time regardless of market fluctuations. Most homeowners who choose this option do so because it provides a clear view of their earning potential for the lifetime of their systems. Since their pricing is locked in, they aren’t affected by prices for SRECs dropping. On the flip side, however, they won’t be able to benefit from SREC price increases.

Open market

Selling one’s SRECs on the open market gives homeowners a bit more control over how much they can earn. Market fluctuations can really work in one’s favor, especially with prices for SRECs at their highest. The one caveat is that SRECs must be sold within three years of producing them. It’s a preferred option for those who want to maximize their return on SRECs but less ideal for homeowners who prefer to be more risk-averse.

What states offer SRECs?

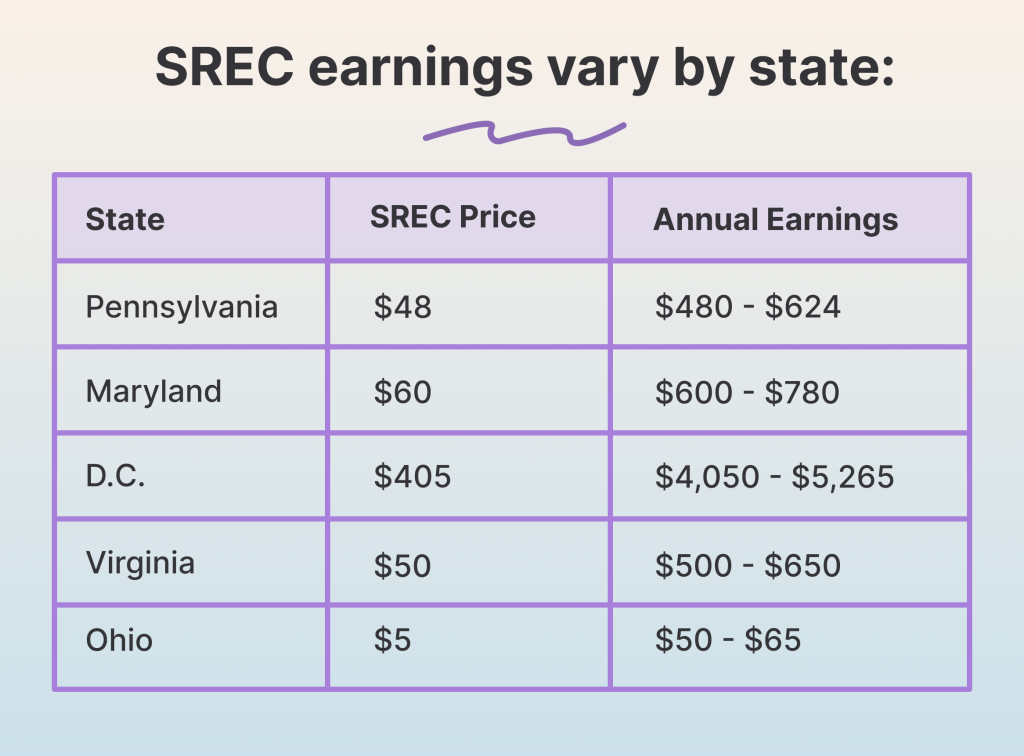

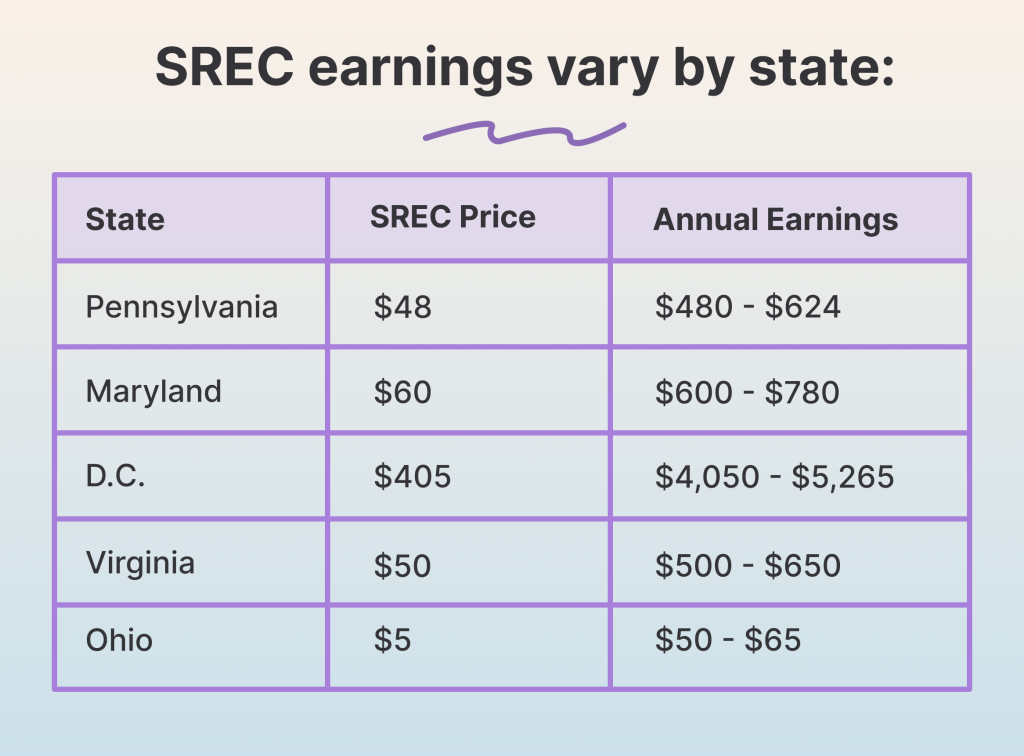

Currently, the following U.S. states and districts offer Solar Renewable Credits to homeowners:

- New Jersey*

- Massachusetts*

- Pennsylvania

- Maryland

- Washington D.C

- Delaware

- Ohio

- Virginia

*States that still have an SREC market, but are no longer accepting new applications for the program.

We’ve included a few examples of what homeowners may be able to earn with SRECs in the chart below (rates based on 2023).

In conclusion:

Solar Renewable Energy Credits are one type of benefit for homeowners who switch to solar. It’s a way for them to recoup some of the cost associated with their solar system installation and at the same time, help the environment by selling their renewable energy to their local utility company. SRECs are not taxable income as long as you don’t earn more money through SRECs than the net cost of your solar system installation.