Home equity loans and HELOCs can make switching to home solar more achievable.

Saving money on your monthly utility bill, gaining energy independence, and living more sustainably are just a few reasons why more and more Americans are investing in solar for their homes. Of course, as with any significant investment, you’ll need to do a bit of financial planning to make it happen.

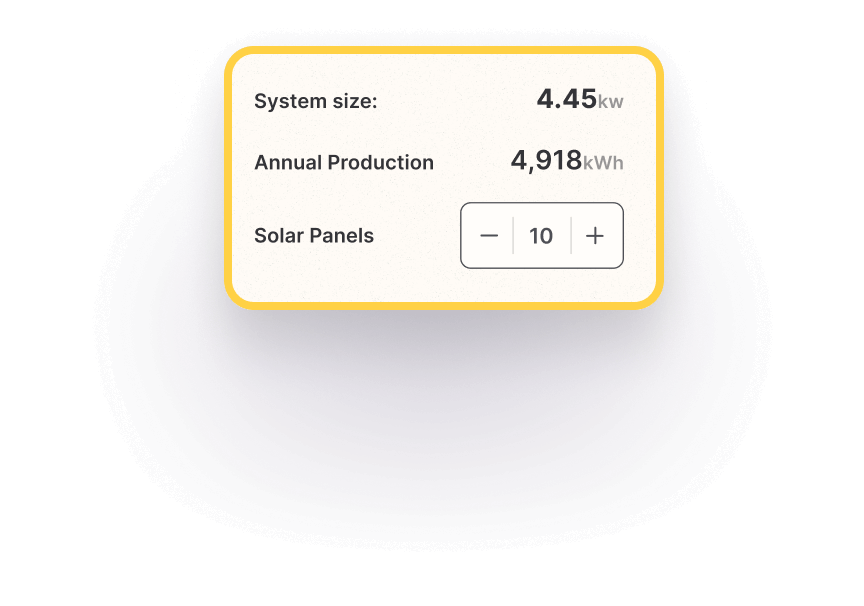

While interest rates for any type of loan–including solar–are high right now, don’t let that deter you from making the switch. Homes that run on solar increase an average of 4.1% in value and typically sell for more than similar-sized homes that don’t. With Monalee, you can recoup your initial investment in as little as four to seven years depending on where you live and your system size among other factors.

In this post, we’ll explore how home equity loans and HELOCs work, what factors to consider before choosing one or the other, and the typical length of these agreements.

What is home equity and how does it work?

In simple terms, a home equity loan is a type of consumer debt. It’s the same thing as a second mortgage or a home equity installment loan. A homeowner might take out a home equity loan as a way to ‘borrow’ against the equity of their homes.

As explained on CNET, home equity is the ‘difference between what your home is worth and what you owe on your mortgage and any other loans secured by your home.’ For example, if a home is worth $300,000 and the homeowner has $200,000 left on their mortgage, they would have $100,000 in home equity.

This type of loan provides a single, lump sum payment to the borrower at a fixed rate. Fixed rates are usually preferable over a fluctuating rate because it’s more predictable. Of course, higher interest rates will mean higher monthly payment amounts.

Securing a home equity loan means that the homeowner is borrowing money from a bank and that they will repay the bank in regular, fixed installments for the duration of the agreement (10-15 years, for example).

If a homeowner isn’t able to follow-through with repayment, the lender can foreclose on the property. For this reason, it’s a fairly low-risk arrangement for the lender.

How does this differ from a HELOC?

A HELOC, which stands for ‘home equity line of credit,’ is set up as a line of credit rather than a lump sum amount. It’s similar to a credit card but has lower–although variable–interest rates and its own set of terms and conditions.

Another difference is that with a HELOC, you don’t need to borrow the entire amount all at once. There’s what’s called a ‘draw period’ where the homeowner can borrow from the total amount. This is typically between five to ten years, and is followed by a repayment period of 10-20 years. During the repayment period, further draws are not allowed.

Unlike home equity loans, your interest rate will likely be variable rather than fixed. However, some lenders are now allowing borrowers to lock in an interest rate for a certain balance–for example, the total amount needed for a home improvement project or installing solar panels.

In summary, here are the key differences:

- a HELOC is a line of credit rather than a lump sum amount

- a HELOC has a revolving line of credit, much like a credit card

- A HELOC allows you to borrow different amounts at different points in time

What are the pros and cons of HELOCs?

There are several benefits of both home solar equity loans and HELOCs, as well as a few factors to consider before signing with a lender.

Pros

- Lower interest rates: In general, secured loans—loans in which the borrower uses an asset (one’s home) as collateral for the loan—are more affordable than unsecured loans.

- Peace of mind: You can secure a HELOC ahead of choosing a solar installer. This allows you to take your time researching different options and finding the best price.

- Tax deductible interest: Assuming you use the money for a home improvement project, such as going solar, the interest on your HELOC and home equity loan is tax deductible.

Cons

- Possible foreclosure: While extreme, there is the possibility that you could lose your home. Similar to a mortgage, home equity loans and HELOCs are contingent on regular monthly repayments.

- Potential to fall into deeper debt: Since HELOCs and home equity loans are fairly easy to obtain, they can sometimes attract homeowners who are not the best at managing money.

- Trouble if/when you sell: The more debt you put against your home, the trickier things will be when it’s time to sell. You might have to sell your home for less than you owe on your mortgage and other loans.

Other ways to finance home solar systems

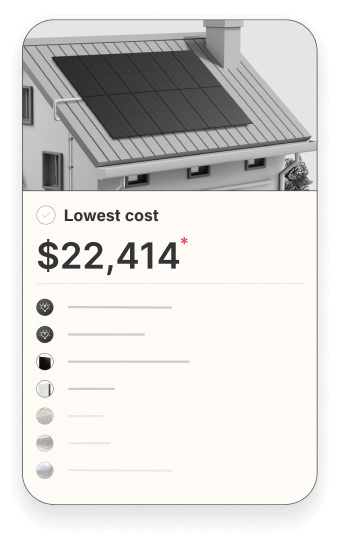

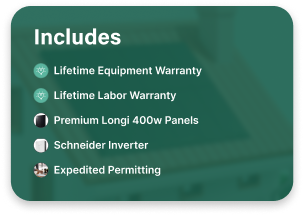

The solar installer you choose might offer a tailored loan to help cover the system’s cost. These companies—including Monalee—often provide end-to-end services, handling installation and financing alike.

There are three additional ways to pay for your solar panels:

In conclusion

There are several ways to finance solar for your home, and HELOCs are a good option for homeowners who want to take their time choosing a solar company. HELOCs and home equity loans also have fairly low interest rates because the borrower is using their home as collateral and this is a significant asset.