These agreements come with certain downsides that shouldn't be ignored.

Going solar is a big investment, and it’s important to explore all your options before moving forward. For homeowners who aren’t able to pay for their systems in full or explore financing options, leasing can be the next best thing.

In this post we’ll cover what it means to lease a solar system vs. own it, and some possible downsides of lease and PPA agreements that many homeowners overlook.

What is a solar lease?

If you’ve ever leased a car rather than buying it outright, solar leases work the same way. In short, a solar lease is a financial agreement in which the company that installs your home’s solar system retains ownership of the system and you pay a fixed monthly fee to use that energy system.

Homeowners who lease are required to pay their monthly fee, while the company who owns the system is responsible for covering upfront costs such as installation and any necessary repairs.

How do leases differ from solar PPAs?

A Solar Power Purchase Agreement (PPA) is another type of financial arrangement. The main difference between a solar lease and a PPA is that with a PPA, the homeowner pays the solar company a non-fixed monthly fee based on the amount of energy generated in that particular month.

As with solar leases, homeowners who go the PPA route are not required to pay upfront costs for installation and maintenance.

5 Downsides of Solar Leases and PPAs

Solar leases and PPAs certainly aren’t all bad, but there are certain downsides that homeowners fail to spot until it’s too late.

Savings are minimal

While there are many benefits of going solar–from saving the planet to energy independence–the main motivator is often money and by money, we mean potential savings and Return of Investment (ROI).

Leases and PPAs offer the least amount of savings when compared to financing and cash, whereas owning your own system offers unlimited savings. Remember that solar equipment is built to stand the test of time (and weather), which means that your system will generate electricity for 25 years or more.

We’ve found that many Monalee homeowners who purchase their systems achieve a return on their investment in as little as five years. Those who go the financing route start saving 20-40% immediately.

Plans change, and long-term agreements lock you in

Even with ‘forever homes,’ life happens and things change. Maybe you need to move to a new location for work, or choose to take care of an elderly family member who lives across the country. It could be anything from wanting to be in a better school district or choosing to downsize once your kids go off to college.

Whatever the reason, change happens and owning your system makes it much easier to make that transition. With leases and PPAs, you’re not able to sell your home without paying off the entire solar lease. Owning your system puts the power back in your hands. If you aren’t able to buy the lease out completely, you’ll need to make sure potential buyers are willing to take over the lease.

There’s trouble down the line if you want to sell your home

This leads us to another downside of solar leases and PPAs: selling your home. Not every potential buyer will want to take over your solar lease or PPA. Sensing reluctance from potential buyers could extend the amount of time your home is on the market; you might also end up lowering the price in order to attract the right buyer.

It’s also worth noting that your home won’t be able to benefit from the average 4.1% increase in value that comes with owning your solar system. For homeowners who purchase or finance their solar and decide to move later, the value of their home is higher than when they moved in and they can reflect that in the asking price. Many buyers are happy to pay more for a home if it already has a solar system installed because it means instant savings for them.

You won’t be eligible for rebates and tax incentives

There are certain federal and state incentives that reward homeowners for going solar. Between 2022-2032, homeowners can receive a 30% tax credit on their installed PV systems (photovoltaic panels, otherwise known as solar panels). The solar tax credit can cover the expenses of your solar equipment, such as the panels themselves, as well as the cost of installation.

On a state level, there are other incentives to which homeowners can benefit. For example, California homeowners who install solar systems will not be taxed on the increase in value of their home. They’re also able to sell excess energy that is produced from their solar system to the local grid and earn credits in return. Some states offer RECs, which allow homeowners to get thousands back every year, just for generating electricity.

When you sign up for a solar lease or PPA, you aren’t eligible for any of these rebates and incentives because you do not own your system. When added up, these rebates and incentives significantly lower the total cost of what it costs to go solar.

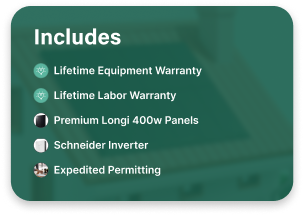

You miss out on solar panel warranties

Even though solar equipment is designed with long-term durability in mind, it’s integral to have warranties in case something does go wrong. Homeowners who are leasing their systems will receive lower-quality maintenance and it will be up to the company who owns your equipment whether or not they pay for the repairs.

Monalee projects come with warranties on solar equipment, installation, and performance. When you sign up with Monalee, you’re backed by the equipment providers we work with. We chose LONGi as our solar panel provider because they are the sleekest, best looking and among the highest performing panels on the market. We use the Schneider Inverter and the Schneider Boost (battery) for the same reason.

Own your system for half the price of renting it

Our rates at Monalee are so low that it is possible to own your energy system for less money than leasing it through one of our competitors.