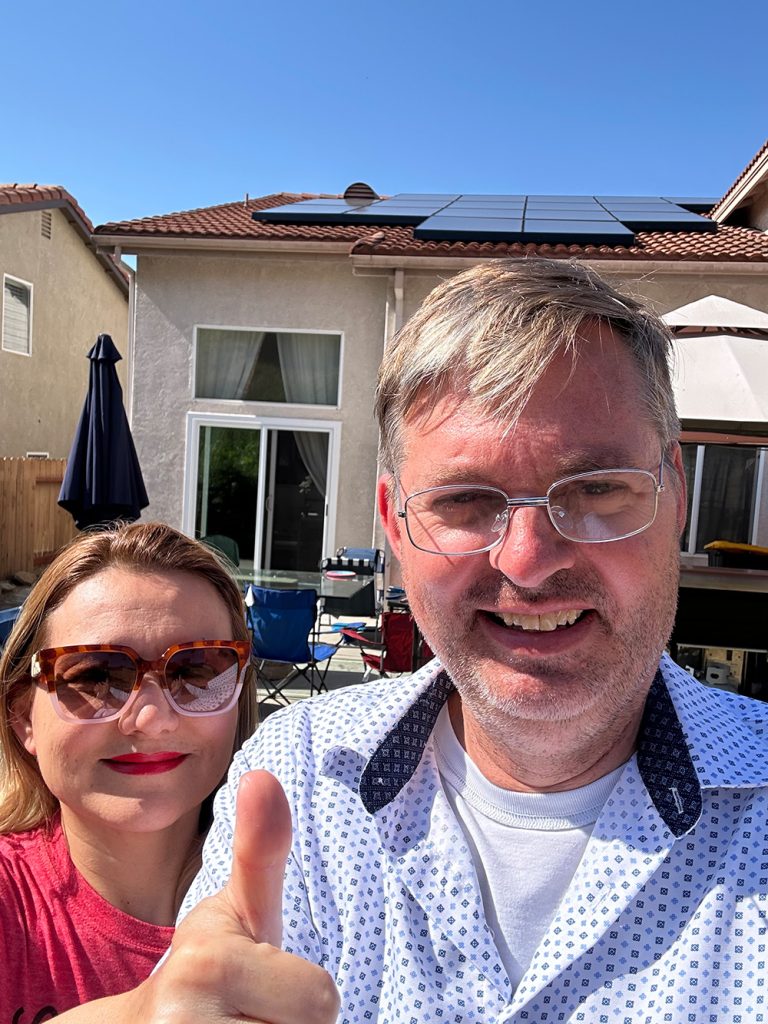

After some early missed promised dates, the install went great. The installers made my particularly picky wife very happy by making everything symmetric and good looking.

Get Price

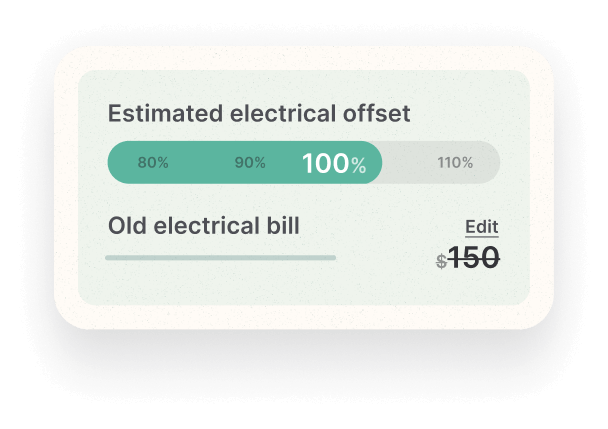

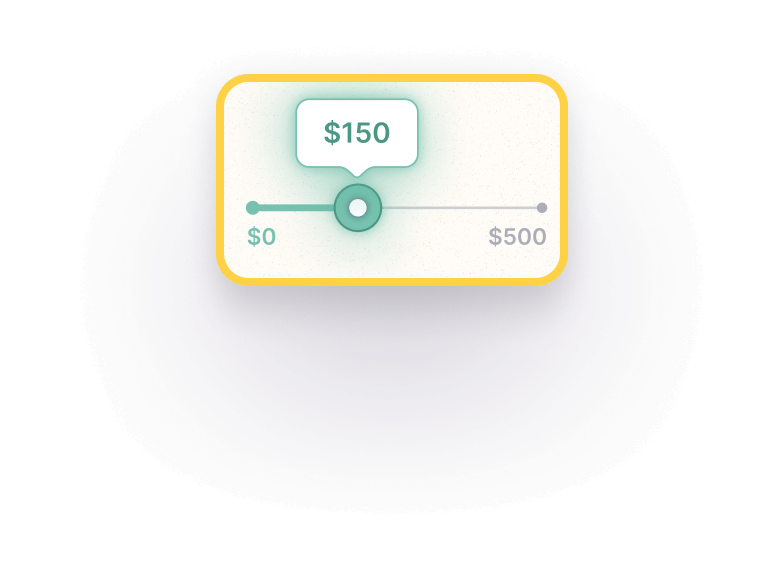

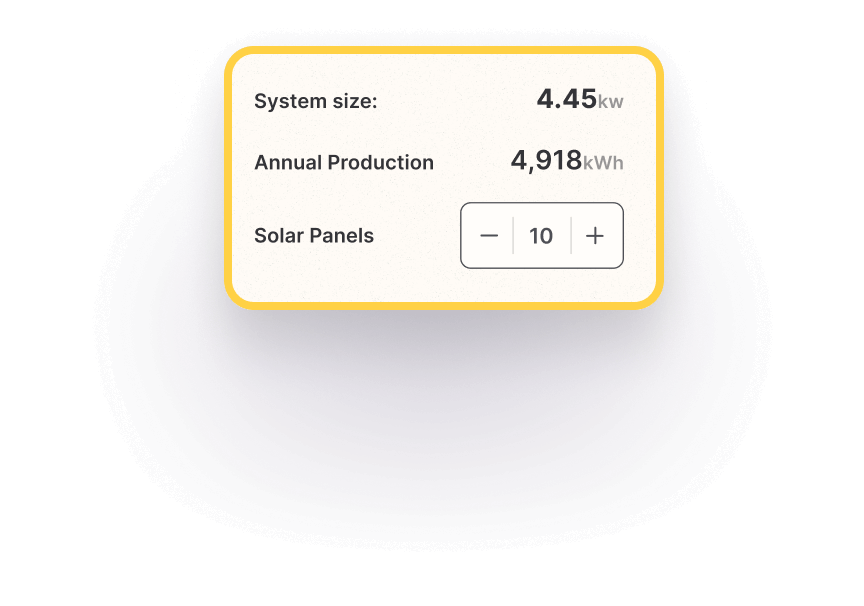

Your Quote

- About Us

- Customers

- Coverage Area

- FAQ

- Guides

- Blog

- Glossary

- Resources

- FAQ Guides Blog Glossary OUR PROCESS 1Kickoff 2Design 3Permitting 4Installation 5Activation FEATURED POSTS

- +1 (844) 666-2533

- Login

- Get Price

- Your Quote

- Get Price

- OUR PROCESS

- FEATURED POSTS