Interest rates now range from 4.75% to 5-percent, which is great news for homeowners.

In case you missed it, last week the Federal Government cut interest rates by 50 basis points. CNBC reports that this is the first reduction in borrowing costs since March 2020 and that the decision to cut interest rates coincides with inflation easing. Interest rates now range from 4.75% to 5% compared to their all-time high rate of 9.1% in June 2022.

This is great news for the residential solar market because it means that more Americans can switch to solar energy for their homes.

In this blog post, we’ll explore how to secure a solar loan, how repayment works, and what this recent cut to interest rates means for the solar industry.

Securing a solar loan

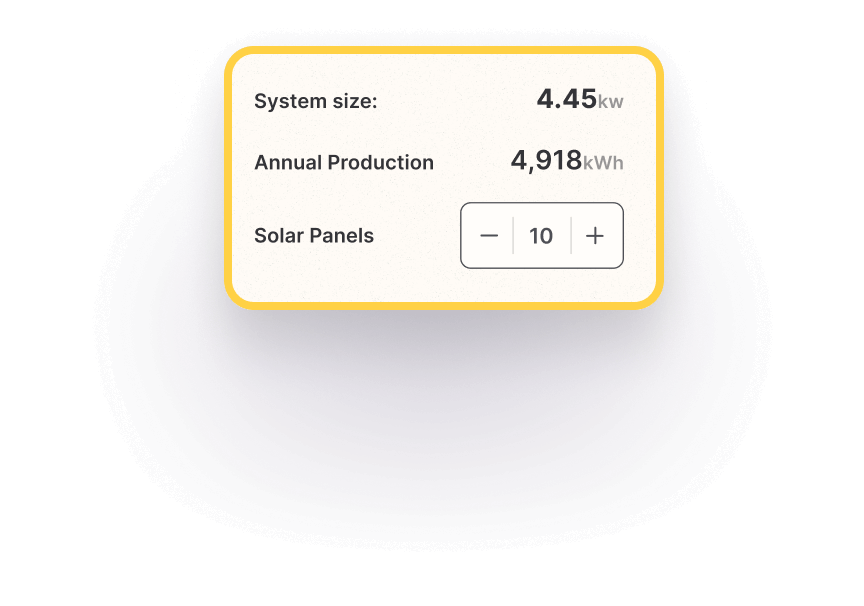

If you’re planning to go the solar loan route, you’re not alone. Switching to solar for your home is a significant upfront investment and it’s not always financially feasible to cover the cost all at once.

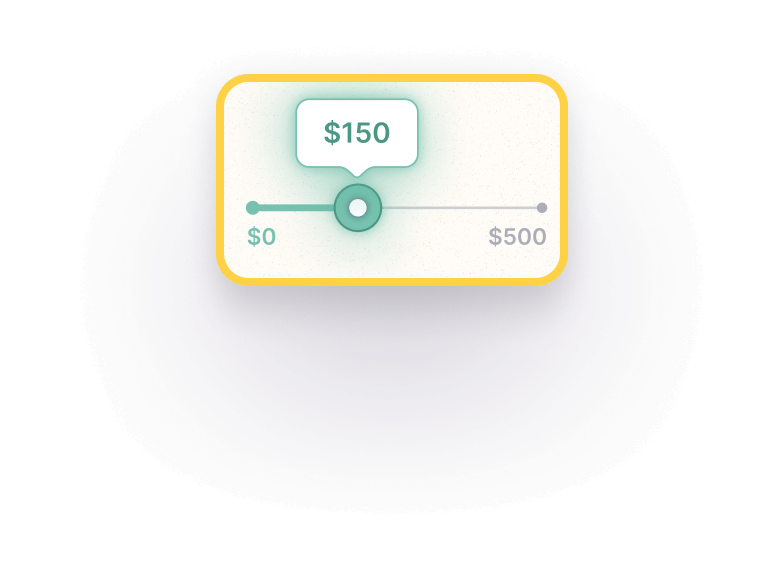

While signing up for a solar loan does lock you in for a set number of years, the good news is that the terms are fairly flexible. In most cases, the homeowner has control over how much they put toward a down payment, and this can be anywhere from 0-100-percent.

Homeowners are also able to set the term–or length–of the loan. In general, this range will be anywhere from 5 years to 25 years, with 12 years being the average.As a general rule of thumb, shorter loan terms will have higher monthly payments but you’ll pay less toward interest.

Why interest rates matter

As we covered in our guide to solar loans, securing a low interest rate is always the goal–although not something you should stall too long over. Similar to mortgage rates, interest rates for solar loans rise and fall based on how well–or poor–the economy is doing. As you probably remember, interest rates plummeted during the pandemic but have since risen.

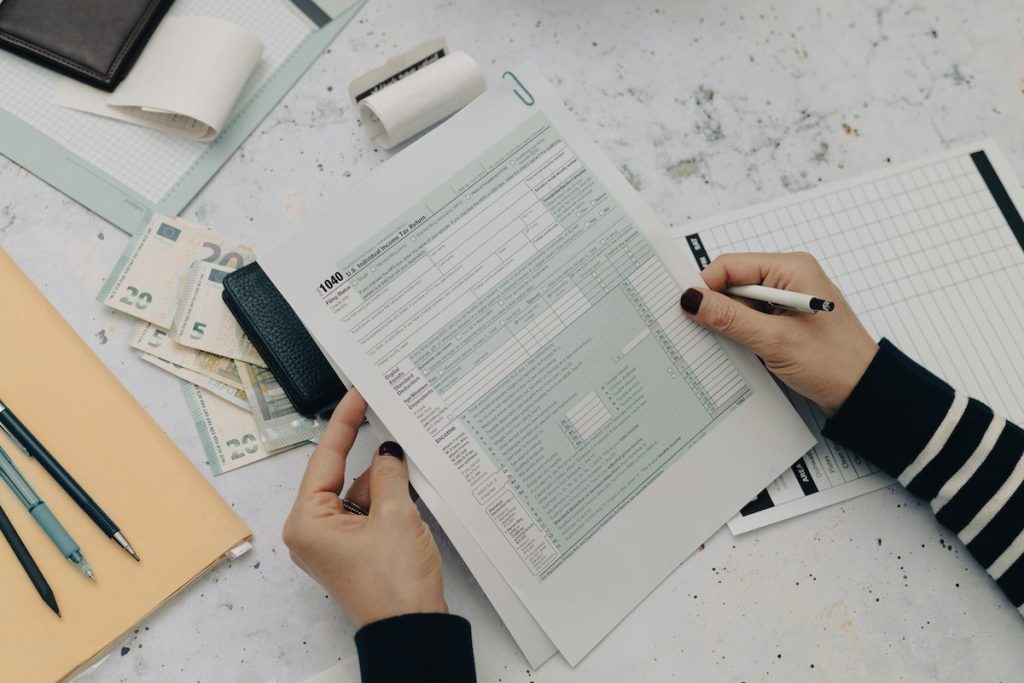

Qualifying for a solar loan is fairly straightforward, but it does involve some paperwork. Solar financiers will check your credit score to ensure that you will be able to make those monthly payments. You’ll want at least a 650 FICO score and anything above a 720 is even better. The higher the score, the higher your chances of securing the lowest interest rate possible.

What lower interest rates mean for solar

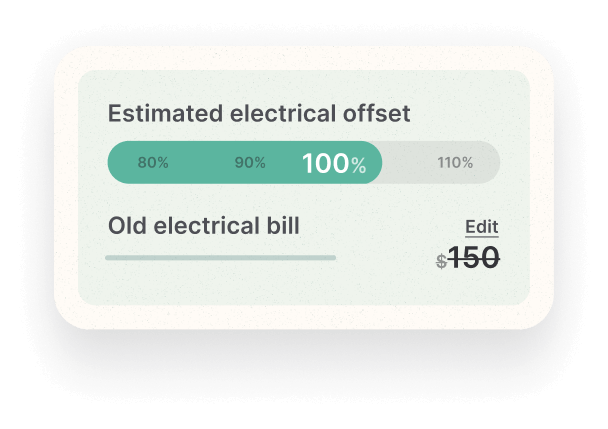

For the many Americans looking to finance their solar installations, securing a solar loan is a great option. However, their monthly payments shouldn’t cost more than what they are already paying for electricity. The higher the interest rate, the higher the monthly payments.

While the solar industry has been experiencing tough times as of late, things are starting to look up. According to the Solar Energy Industries Association trade group, residential solar installations are expected to slump 19% this year. Having a lower interest rate on solar loans equates to thousands of dollars they are saving in interest over the lifetime of their systems.

We’re looking forward to more Americans achieving energy independence through home solar, storage, and EV charging.